Posted on: August 2, 2022, 08:51h.

Last updated on: August 2, 2022, 11:51h.

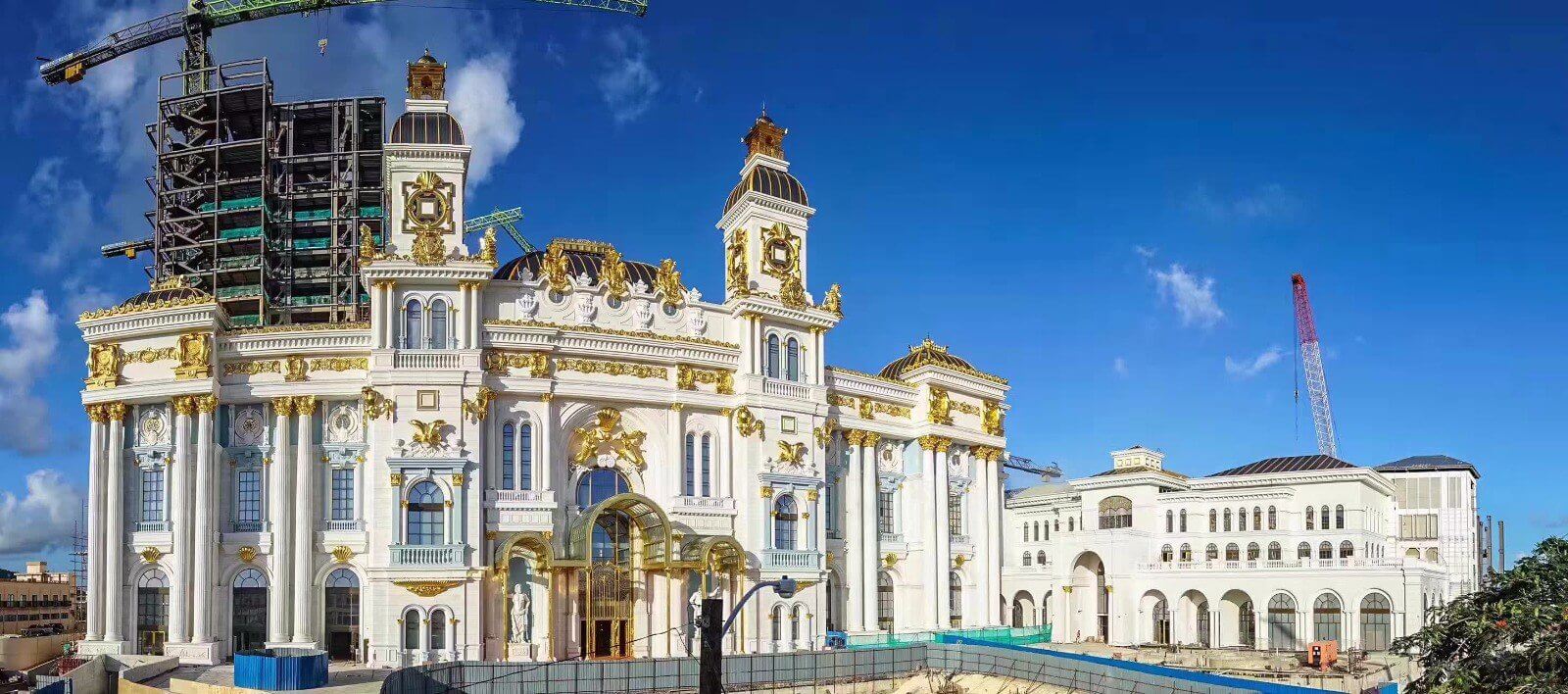

Imperial Pacific International (IPI) has been claiming for months that it’s going to receive a massive injection of funds “any day” to save its exclusive casino license in Saipan. Unfortunately, any day never seems to arrive, and the company behind the Imperial Palace is getting further in debt with the Commonwealth of Northern Mariana Islands (CNMI).

Last week, the CNMI’s Commonwealth Casino Commission (CCC) put IPI on display once again. It showed how the company’s debt is surpassing the $100 million mark, putting the US-supported territory in a financial vise.

IPI has been desperately clinging to the hopes of retaining its suspended license for Imperial Palace. It reportedly was working out a deal with the CCC to reach its goal. But the latest revelations hint at no settlement on the horizon.

IPI Still Unable to Fulfill Obligations

IPI owes regulatory fees and royalties for 2020 and 2021. Additional fees are coming due this month and in October, which means IPI will have an outstanding debt of about $103 million by that time.

Meanwhile, the company is also dealing with legal battles that add tens of millions of dollars more. As a result, even if it were to receive any of the $150 million it claims to be waiting on, it would need to spend almost every penny just to cancel the old debt.

IPI reportedly worked out a deal to receive the funds from a South Korean investment company, IH Group. Initially, it was to receive a round of funds in May. But according to the most recent information, only a small amount of money has changed hands.

IH Group will take over a significant amount of Imperial Palace. It will reportedly operate the casino, as well as some of the property’s luxury villas. It will also take over the construction of the hotel tower, which has been on hold because of COVID-19 and IPI’s legal and financial troubles.

However, that also produces new questions. Even if IPI receives all $150 million, it will need virtually every penny to cover outstanding debts and other financial obligations. That leaves nothing to cover operational expenses or construction. So IH Group, or someone else, will have to inject more funds, which only leverages the property further.

There’s also the issue with IH Group operating the casino. It has to have permission to do so from the CCC, and there’s no indication that anything is in place to facilitate the transition.

IPI Plays Victim as Claims Against IH Group Emerge

IPI’s failures have never been the result of the company’s actions or inactions, according to statements it has repeatedly made. The same holds true now. A few days ago, according to the Saipan Tribune, IPI reported having received just $245,000 from IH Group.

However, the money is moving very slowly, and IPI is allegedly growing more frustrated. As a result, it told the CCC that it is considering breaking the agreement if IH Group doesn’t come through.

The subject came before the CCC because of the repeated delays, but also because of a surprise revelation. A former IPI employee, Vicente Aldan, told the regulator that IH Group is nothing more than a scam. He added that it has no money.

Aldan, according to Marianas Variety, claimed that an investigation unveiled some concerns about the company. It has a phone number in Rota in the CNMI, but it doesn’t work. When someone tried to visit IH Group’s reported headquarters in South Korea, they found that it wasn’t there.

IH Group, on its website, listed a casino hotel and a shopping mall in Rota. It also listed development work at the Rota International Airport. All three claims, however, are bogus. IH Group’s website, ihgroup.kr, went down for maintenance soon after.

IH Group has said it will sue Aldan for slander because of his assertions.

The CNMI and the CCC are suffering because of IPI’s repeated negligence. As a result, the CNMI has not been able to meet its financial obligations and the CCC, where it once employed almost 50 people, now only has a complement of nine.

Unless something materializes this month, the CNMI courts may decide to move forward with the CCC’s request to permanently revoke IPI’s license.