Posted on: May 20, 2022, 09:05h.

Last updated on: May 20, 2022, 10:20h.

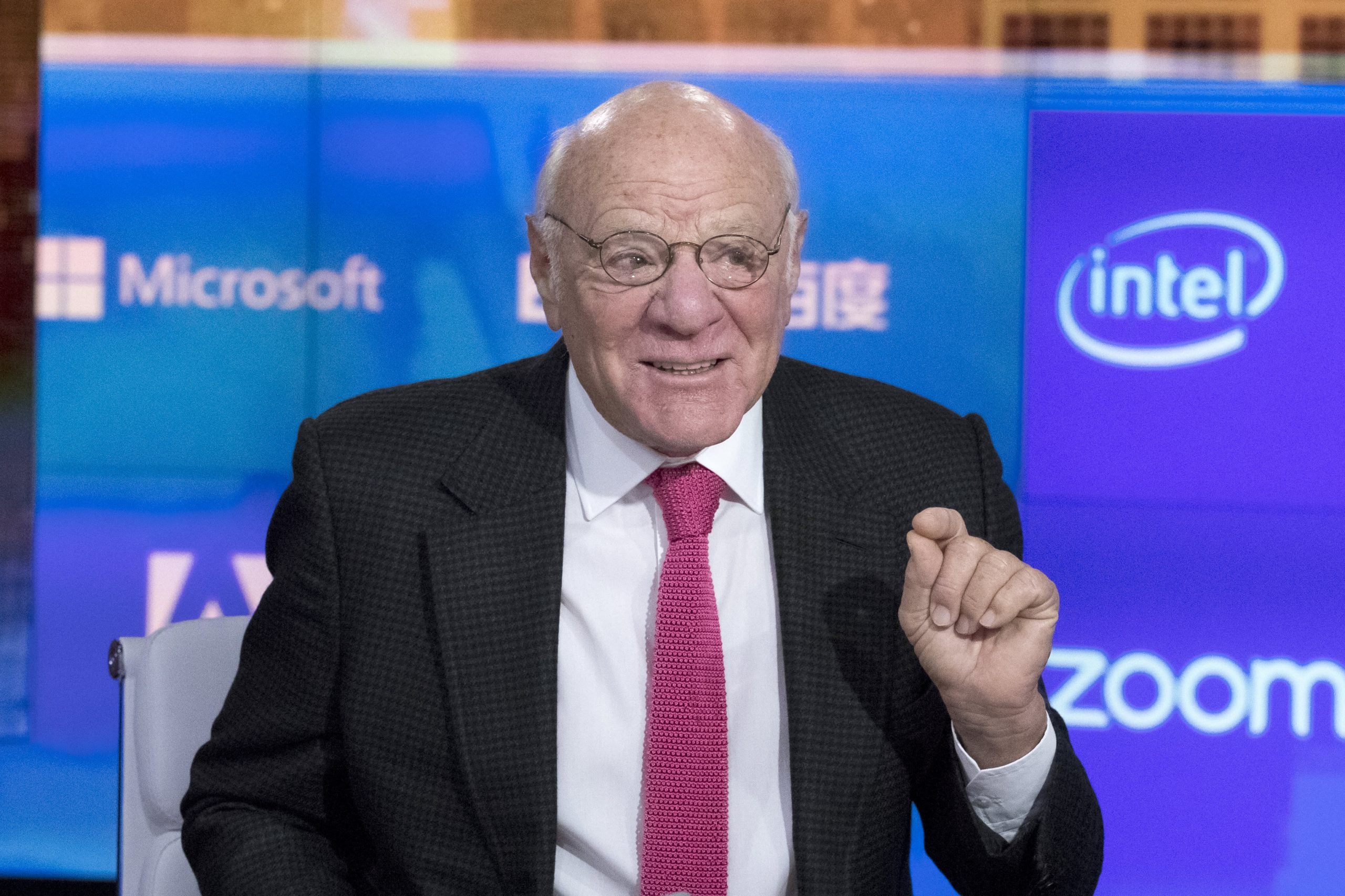

The Nevada Gaming Commission (NGC) has granted a limited license to Barry Diller, the media mogul whose IAC/InterActiveCorp (NASDAQ:IAC) is the largest shareholder in MGM Resorts International (NYSE:MGM). That’s following an inquiry into a federal investigation of the billionaire’s purchase of Activision (NASDAQ:ATVI) call options ahead of Microsoft (NASDAQ:MSFT) announcing a takeover bid for that video game publisher.

In March, news broke that the US Department of Justice and Securities and Exchange Commission (SEC) are looking into whether or not options trades placed by Diller, his stepson Alexander von Furstenberg, and entertainment executive David Geffen on the video game company could constitute insider trading.

Prior to the insider trading probe being revealed, the Nevada Gaming Control Board (NGCB) recommended licensing for Diller and IAC. The NGC previously said it wants the NGCB to look into Activision options inquiry.

At its May 19 meeting, the Commission voted 4-1 in favor of a limited license for Diller and IAC CEO Joey Levin, who is not part of federal regulators’ insider trading investigation.

For Diller, Limited License Not So Bad

For Diller and Levin — both of whom are MGM board members — the limited license isn’t a bad thing. It simply means they have to wait two years before applying for full permits. That time frame could be reduced if the Justice Department and the SEC opt not to charge Diller with any wrongdoing.

Diller can continue to serve as a board member under the limited license and engage in other business activities tied to MGM. The limited license only restricts the time frame for which he is approved,” according to the Wall Street Journal.

The NGC’s decision arrives barely more than a week after Levin spoke glowingly about IAC’s MGM investment in his annual letter to the conglomerate’s shareholders.

“We bought our first share of MGM Resorts International for $12.17. We went on to buy another $1 billion worth of MGM shares over the following twelve weeks because the market provided us with what we described at the time as a once-in-a-decade opportunity to own the largest stake in a category leader at an unreasonably low price relative to risk,” writes Levin.

New York-based IAC owns 15% of MGM equity.

Diller Speaks Out

Diller, 80, previously commented on the purchase of Activision call options, noting it was no more than a “lucky bet.” He attended the NGC meeting, further elaborating on the situation.

“I recognize that such a neat coincidence, people are going to look at it,” he told the commission. “I thought immediately that they would…I said, ‘Let’s be certain we keep all the records so that whenever this is investigated, which it surely will be, that facts can be known, which is, we had no knowledge.’ ”

Commissioner Ogonna Brown was the lone vote against a limited license for Diller and Levin. But that vote was placed because she supports fully licensing them. She noted at the meeting that there’s no reason to question Diller’s integrity.