Posted on: May 26, 2022, 08:25h.

Last updated on: May 26, 2022, 08:37h.

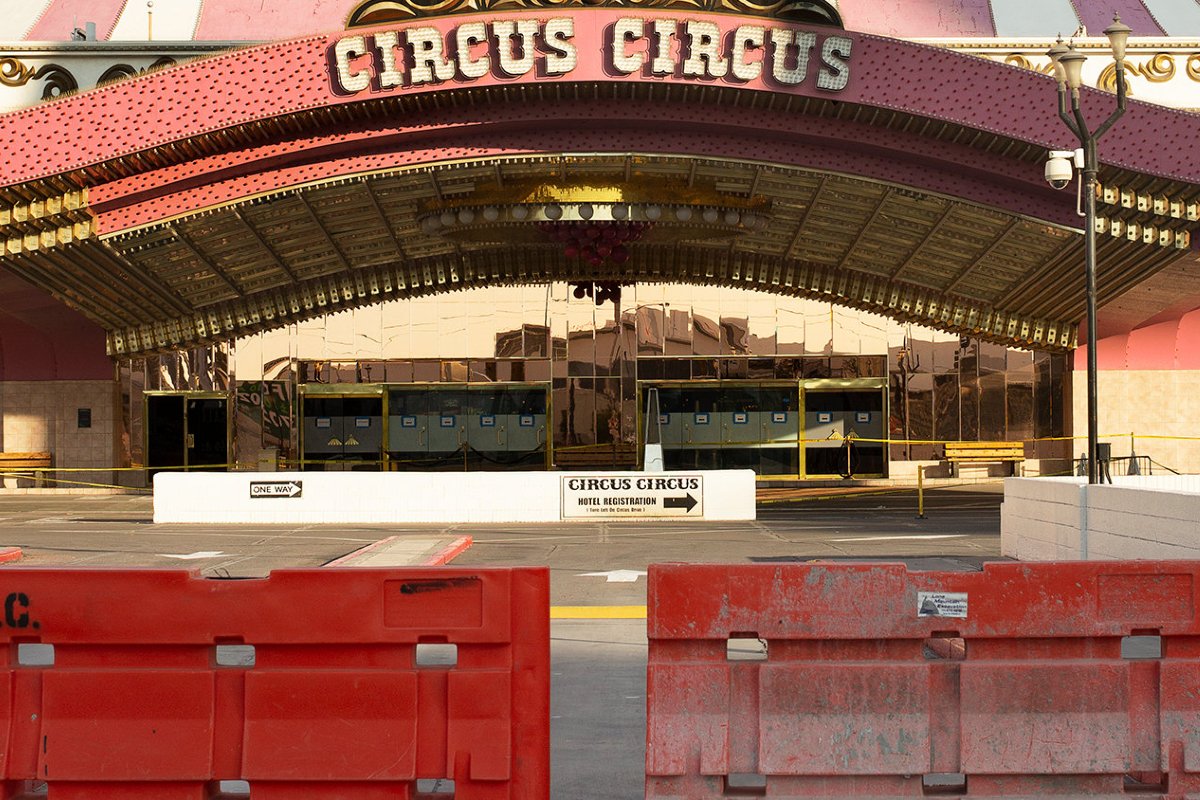

The Circus Circus lawsuit against American International Group Inc. (AIG) over COVID-19 insurance claims has been officially dismissed.

The US Court of Appeals for the Ninth Circuit in San Francisco in April ruled that AIG was not liable to compensate the Las Vegas Strip casino for financial damages caused by the pandemic. The federal court upheld Nevada US District Court Judge Jennifer Dorsey’s March 2021 opinion that concluded the pandemic did not result in physical damage to the resort, and therefore, property insurance claims were unjust.

Circus Circus attorneys representing billionaire owner Phil Ruffin argued that since the coronavirus was physically present at the north Strip budget-friendly property, the resort is entitled to insurance compensation. But the Ninth Circuit agreed with Dorsey that Circus Circus did not suffer direct physical damage.

“Despite Circus Circus’s allegation that the COVID-19 virus was present on its premises, it has not identified any direct physical damage to its property caused by the virus that led to the casino’s closure,” a three-judge Ninth Circuit panel ruled.

AIG is one of the nation’s largest insurers. The company reported revenue of more than $52 billion last year alone.

Appeal Rejected

Following the Ninth Circuit’s ruling last month, Circus Circus attorneys petitioned the court for a full “en banc” hearing involving the court’s full bench. En banc hearings are rare. The US Court of Appeals for the Federal Circuit explained on its website that, “Each three-judge merits panel is charged with deciding individual appeals under existing law as established in precedential opinions.”

Circus Circus still thought it had a case in petitioning the full Ninth Circuit. The Ninth Circuit said the casino didn’t.

The panel has voted to deny the petition for panel rehearing. The full court has been advised of the petition for rehearing en banc and no judge has requested a vote on whether to rehear the matter en banc,” Molly Dwyer, clerk for the Ninth Circuit, said in a filing dated May 24, 2022.

“Circus Circus’s petition for panel rehearing ad rehearing en banc is denied,” the document concluded.

Insurance Wins

COVID-19 devastated businesses, but courts have repeatedly ruled that the health crisis does not warrant property insurance claims.

According to the University of Pennsylvania’s “COVID Coverage Litigation Tracker, there have been approximately 2,300 insurance lawsuits brought against carriers for refusing to pay out on COVID-19 property claims. But to date, none of the lawsuits have resulted in insurers being forced to pay out.

Courts have consistently reached the verdict that the coronavirus itself did no physical damage to businesses seeking property insurance distributions.

“At the appellate court level, insurers have prevailed in the first 28 decisions from the US Circuit Courts of Appeal, with the Second, Fourth, Fifth, Sixth, Seventh, Eighth, Ninth, Tenth, and Eleventh Circuits ruling for insurers under the laws of multiple states,” explained insurance attorneys Sarah Anderson and Scott Seaman of Hinshaw & Culbertson in Chicago. “These courts have ruled in insurers’ favor based on the lack of ‘direct physical loss or damage’, as well as virus, microorganism, loss of use, and ordinance or law exclusions.”